Can I afford to buy a home?

Category News

Before you head off to search for your dream home, you can save a lot of time and effort by knowing upfront what instalment you can afford each month, and what the bank is likely to finance you for.

While there are many important factors that need to be considered in the financial assessment of home ownership, these helpful tips from Hollard will specifically help you determine your affordability based on gross income and in turn, better manage your expectations:

-

Work out the instalment you can afford - banks will allow you to have a maximum monthly instalment amount equal to roughly 30% of your gross income. This is known as the Repayment-to-Income ratio (RTI). On a gross salary of R27k as an example, 30% of that will be R8100 (R27 000 x 30%). Knowing the maximum instalment that a bank will allow per month can then be factored into your own affordability calculation and will help guide you on what property values to look at. But do remember that the RTI calculation is merely an indication and you need to factor in all your other expenses to make sure you can afford the instalment.

-

Now work out the purchase price range - using the instalment amount that the RTI ratio gave you and working with three key assumptions – Interest rate, repayment term and expected loan amount – you can work out the purchase price range you should be looking in. You can do this using the handy online calculators available on many of the bond originator or bank websites which is much easier , or if you’re proficient with Excel, calculate it using the PV formula in Excel: =PV(rate,nper,pmt[fv],[type]) (If your immediate reaction right now was “huh”, make use of the handy online bond calculators – they are just as accurate and much easier). In Excel, If you assume an interest rate of 10% (rate), a loan term of 240 months (nper) and an instalment amount of R8100 (pmt) then the formula and result will look as follows: =PMT(10%/12,240,8100) = -R839 359.41. This means that you should be able to get a loan amount of around R839k. When determining what interest rate to use, always make sure you use a reasonable one, and not the best one you think you can get. Always allow some leeway for interest rate hikes, rather than buying at the absolute max that you can afford.

-

Remember the deposit: Keep in mind that 100% loans from the bank are difficult to secure, especially if you are a first time buyer, so you will need to factor in a deposit which you need to pay out of your own pocket. Depending what deposit you have available, you can shop at a level slightly higher. For instance if you know that you will probably be able to afford a R800 000 property based on the RTI rule, and you have a 10% deposit, you can consider a property of around R880k as the loan will amount will come down to R800k after the deposit has been paid. Don’t forget to keep cash available for other upfront costs such as transfer duty, and conveyancing fees which also need to be paid out of your pocket before the transfer can take place.

-

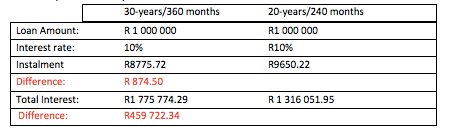

Repayment Term makes a big difference: When calculating the instalment amount you would have guessed a couple of numbers, one being the interest rate and the second the term of the loan that you will be opting for. Banks offer home loans of up to 360 months (30 years), but the most common term used when applying is 240 months (20 years). Pertinent to remember is that the longer the term you select, your instalment might be lower, but you will pay a much higher total interest over the life of the loan.

Here’s a practical example:

Your monthly instalment might decrease by about R874 per month on a 30-year loan, which makes it a little bit more affordable, but the amount of interest you pay is almost a whopping R460k more than you would pay over 20 years. The term that you select when applying can make a big difference so consider it carefully.

-

Get a Home Warranty to protect your finances – When you’re stretched to the max with deposits, bond and transfer costs, municipal deposits, moving costs and so on, the last thing you need is unplanned bills to fix hidden defects. Protect yourself from the unexpected and potentially devastating costs of discovering defects after the sale of a property has gone through with a Home Warranty which addresses the issues around defects with a professional property inspection that is coupled to an insurance policy. This protects you as the buyer against the financial ramifications of any hidden defects that may emerge in the property for two years after taking transfer. A home warranty will provide a professional inspection report that lists any exclusions or defects, so you know what you are dealing with when it comes to negotiation time. And the best part is you don’t have to foot the cost as it is covered by the seller – all you have to do is ask for it in your Offer to Purchase!

When it comes to property transactions, making sure the homework is done beforehand so that you can comfortably afford your dream home is priceless.

Author: Hollard